Tax Preparation 101

Tax Preparation 101: Useful Tax Forms

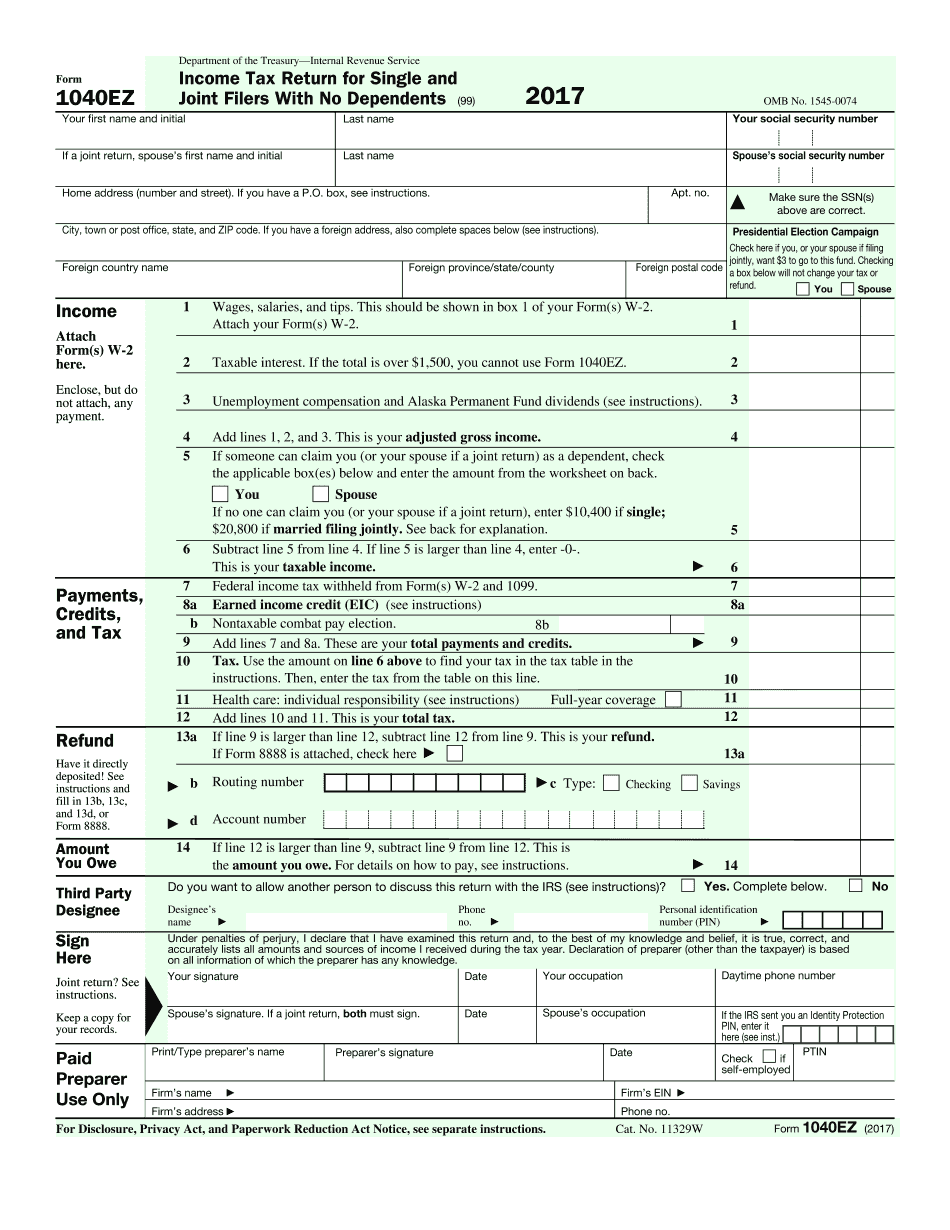

Submit Form 1040-EZ in minutes, not hours. Save your time required to printing, putting your signature on, and scanning a paper copy of Form 1040-EZ. Stay effective online!

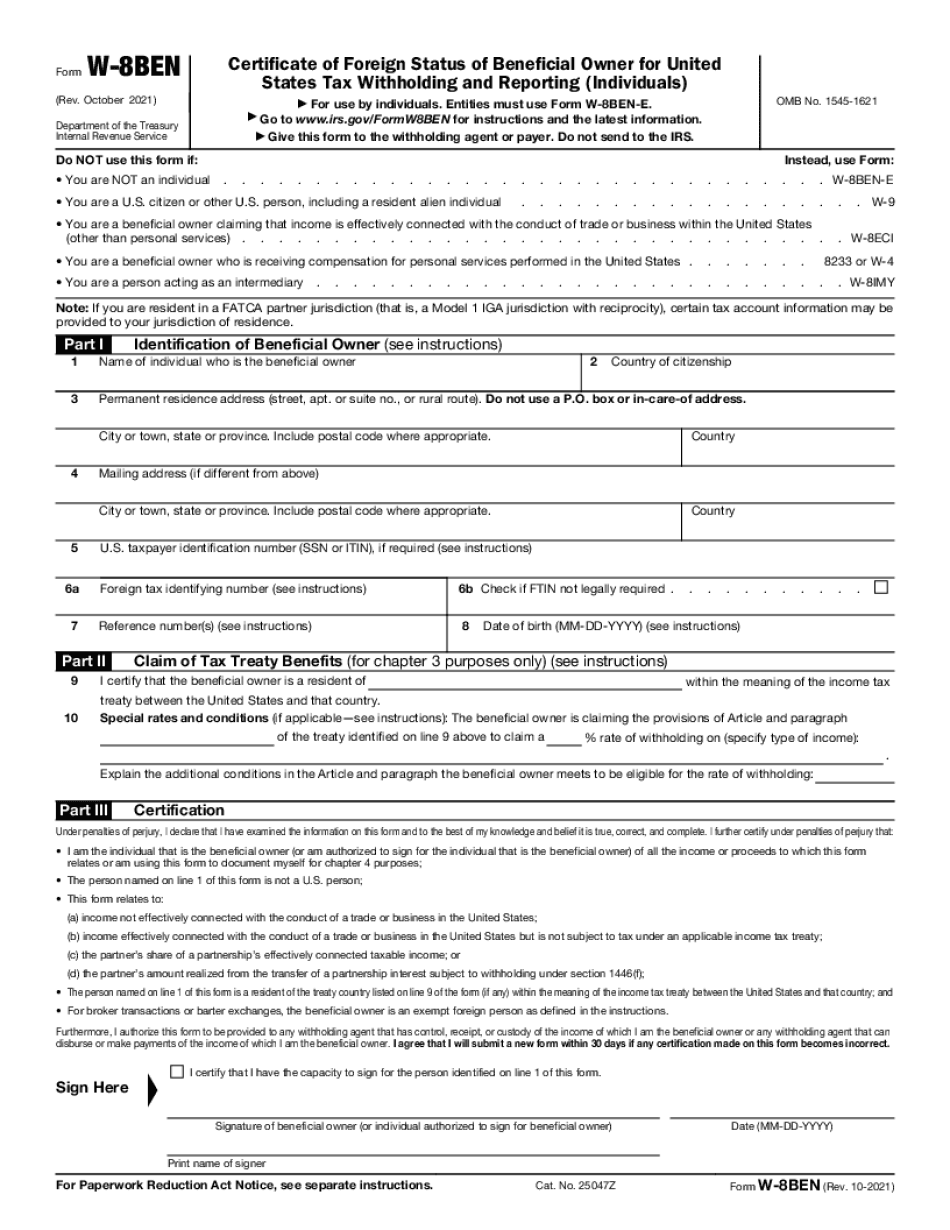

Form W 8ben. Avoid paying extra taxes by filling PDF templates electronically W 8ben. Edit, sign, print and download documents easily. Save time and efforts!

Video instructions - Tax 101

Instructions and Help about Tax Preparation 101

Let’s start with the basics: how does the U.S. tax system actually work? Well, paying your taxes is a lot like filling up a line of progressively larger buckets. Each bucket corresponds to a specific tax rate, like 10%, and to a specific range of income, like, $0 to $9,225. As your income grows, you fill up more and more of these buckets, called brackets, each one with its own tax rate. In addition to this, you’ll also need to pay what’s called a FICA tax, which is a flat 7.65% tax on any money you've earned. Sounds simple enough right? Well, unfortunately taxes in real life are a bit more complicated, so let’s use a more detailed example. Let’s say Ray made $30,000 last year. That’s his gross income, literally the amount of money he made at Corporate Co. before taxes. This number can then be refined into what’s called adjustable gross income, or AGI, by subtracting certain expenses called adjustments or above-the-line deductions. For example, if Ray paid $1,000 in combined student loan interest, his AGI would move from $30,000 to $29,000. This AGI can then be lowered even further if Ray takes an exemption. An exemption is a flat $4,000 reduction in AGI available to each taxpayer for himself, his spouse, and each of his dependents. For example, if Ray takes his exemption, his AGI, currently at $29,000, will be lowered to $25,000. Ray can lower his AGI even further by taking a deduction. Unlike exemptions, deductions depend on the expenses of each taxpayer. So what does that even mean? Well, there are several types of expenses, like charitable donations or mortgage interest, that can be used lower AGI. These are called itemized or below-the-line deductions. If Ray lacks these specific expenses, he can instead take a standard deduction, which is a flat, $6,300 reduction in AGI as of 2015. However, there’s a catch: if you choose to take the standard deduction, you can’t also itemize your deductions, so be sure to pick whichever one is greater. So let’s assume Ray takes the standard deduction. That means his AGI, currently sitting at $25,000, will be lowered to $18,700. That number is Ray’s taxable income, literally the amount of money eligible to be taxed by the IRS. From there, if Ray plugs that number into the 2015 tax brackets, he’ll find Ray owes about $2,300 in federal income tax. Considering that Ray started with $30,000 in gross income, that seems like a pretty good deal. However, there’s actually one more tool Ray can use to save money: tax credits. Unlike exemptions and deductions, which lower AGI, tax credits directly lower your actual tax payments. For example, let’s say Ray is eligible for a $1,000 tax credit. This credit can then be used to offset his $2,300 tax bill, leaving him owing $1,300 in income tax, plus the money for the FICA tax, which will have already been taken automatically from his paycheck. So that’s the end of taxes right? Well, not quite. Ray may also have to supplement his federal taxes with state income taxes. Thankfully however, these taxes are calculated in a very similar manner to federal taxes, and are almost always lower. Hopefully you and Ray now have better understand how taxes work. Be sure to check out our next video, where we’ll teach you whether or not you need to actually file a tax return, and be sure to check out our website, where you can find more educational material and free recommendations for great tax-filing software.